Products You May Like

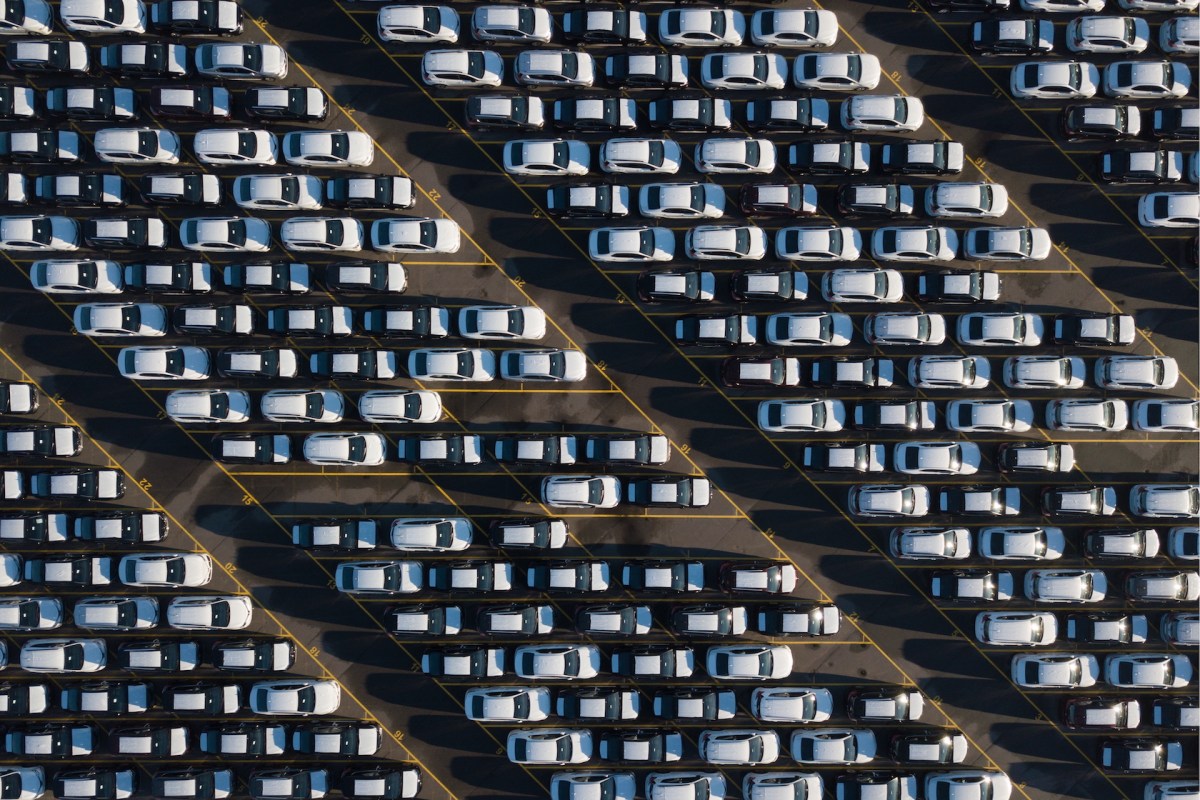

The Indonesian used car market is on a course for growth fueled by a number of trends: the increasing digitization in used car sales; a larger variety of finance options; and the COVID-19 pandemic, which pushed the idea of private car ownership.

Broom, an Indonesia-based auto-financing startup that wants to help used car dealers work more efficiently by applying the asset-backed lending model to their businesses — offering in-app trading among dealers and providing new financing to do so — said Tuesday it has closed a $10 million pre-Series A financing round led by Openspace Ventures.

Other investors, including MUFG Innovation Partner, BRI Ventures and its previous backers like AC Venture and Quona Capital, also participated in the latest round. (Broom declined to comment on whether it or its investors have been affected by the unravelling Silicon Valley Bank crisis.)

The startup was founded when Pandu Adi Laras, chief executive officer (CEO) and co-founder of Broom, wanted to sell his car a few years ago, which he was doing because he needed cash to renovate his house. However, the used car dealers Laras visited told him they could not afford to repurchase Laras’ car due to limited money in hand and working capital, only offering trade-ins instead.

“The traditional approach is more like opening mom and pop stores, where sellers need to wait for their inventory to get sold [to end customers], and then they can use the money to get new inventory to sell,” Laras said.

The issue was quite common among used car dealers in Indonesia, according to Laras, and that was how he came up with the idea of Broom.

Co-founder and chief financial officer (CFO) Andreas Sutanto and Laras started Broom in 2021. The following year, it launched its flagship service, Buyback, to help used car dealers in Indonesia, many of whom lack access to capital.

“With Buyback, [car dealers] can optimize their inventory and accelerate the turnover, thus increasing their revenue; our app lets them manage the in and out flow easily and trade with other dealers in our ecosystem,” Laras said.

Buyback provides dealers with “short-term working capital through a temporary car sale service with a repurchasing option” and dealer-to-dealer trading, making inventory management more efficient. The startup explained Buyback is “not a loan per se, but it’s more of a temporary sale, which includes a change of ownership. The dealers then can repurchase their item at a slightly higher price.”

(left to right) Andreas Sutanto, co-founder & CFO ; Pandu Adi Laras, co-founder & CEO; Claussen Sindhuwinata, COO. Image Credits: Broom

The latest funding, bringing its total raised to $13 million in equity, will enable Broom to diversify its product offering and accelerate inventory turnover for Broom and its dealers. The company recently soft-launched its first offline showroom where its dealer partners can showcase their inventory to more end customers. Besides the equity financing, Broom secured a $12 million loan from DBS Indonesia and BRI last year. The startup aims to double its credit facility from external lenders to handle more transactions.

Broom says more than 5,000 used car dealers, its main target customers, now use its platform in Indonesia, contributing approximately 30.6% of new automotive sales in Southeast Asia. On average, using its Buyback platform has enabled dealers to increase 3x their inventory size, sales and profitability, according to Broom. The company focuses on Indonesia, where the used car market is estimated at $65 million and is expected to reach $70.3 billion by 2027. Broom has the opportunity to provide its solution to dealers and later direct customers.

Some automotive marketplaces, such as Carro, Carsome and OLX Indonesia, cover direct customers’ trade and financing. Broom has tried to differentiate itself by aiming to empower existing dealers, which number more than 50,000 in Indonesia.

Broom’s technology plans include building an intelligence model for assessing car quality.

The outfit employs 120 people.

“Indonesia’s used car market is huge but fragmented and disorganized,” Nobutake Suzuki, president and chief executive officer of MUFG Innovation Partners, said. “Broom is taking a novel approach to developing asset-backed lending solutions that are more flexible, lower cost and accessible, helping to empower the small-sized dealers that dominate used car transactions in Indonesia.”