Products You May Like

Slope, which provides businesses an easy way to offer buy now, pay later services, has had a busy six months. That’s not much of a surprise, given that the buy now, pay later market size was valued at $16 billion in 2021 and is poised to grow nearly six times by 2029.

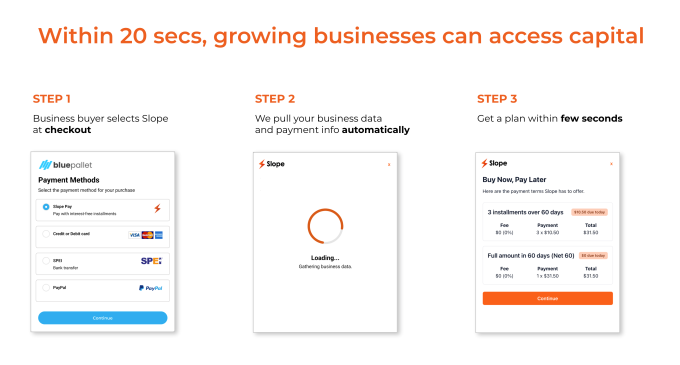

Its API technology can approve businesses for the BNPL in seconds so they can begin offering the installments. At checkout, customers choose the payment terms that work for them. Slope manages the lending, underwriting and any debt collection, and will pay out to the business once the product or service ships.

Coming off an $8 million seed round announced last November, company founders Alice Deng and Lawrence Murata say the biggest thing that has happened is growth. During that six-month period, they saw around 121% growth month over month and signed up enough enterprise customers to grow more than 20 times in the quarter, while its waitlist grows each week, Deng told TechCrunch.

“We’ve gone from a minimum viable product to scaling on enterprise partners, so we are going to do a huge push in hiring, which is something we were not doing before, so we can build out things so that more customers can be onboarded,” she added.

Slope process. Image Credits: Slope

It is now enabling financing for over 2,500 businesses in the U.S. and Mexico, and B2B merchant partners include PlastiQ, Frubana, Meru.com, Blue Pallet and Go4U. They say customers are seeing average orders increase by 168%, which is almost three times the basket size. Slope is taking around 26% of total gross merchandise value of a marketplace, which Deng called “very promising numbers,” and “an inflection point, which is why we want to prepare to scale.”

They are continuing to see tailwinds from the global pandemic in terms of businesses shifting payments online and their customers becoming more comfortable paying via that method. One of the areas where Murata says Slope is differentiating itself from other financial providers is its focus on a developer-centric approach, where others are taking a finance-centric approach, and “integration and underwriting have been so bad as a result,” he added.

From the start, they say Slope wanted a process where businesses didn’t have to fill out a 20-question form or wait days to be approved for buy now, pay later. Instead, the underwriting process is fully automated and takes seconds, while the technology integration takes minutes versus months.

In addition to the growth, the company announced today a new round of funding, $24 million in Series A financing, co-led by Union Square Ventures and Monashees, with participation from Tiger Global Management, Global Founders Capital and a group of founders and executives from companies including Dropbox, DoorDash, Opendoor, Plaid, Rappi, Deel, Brex, Faire, Affirm, Adyen and Checkout.com. The new investment gives the company total funding of $32 million.

As mentioned, Slope intends to use most of the new funding for hiring and to scale. It has a small team of eight right now and plans to grow that to 30 over the next five months.

Ashish Jain, CFO of Slope. Image Credits: Slope

One of the new hires already working is Ashish Jain, who came in as chief financial officer. Previously, Jain most recently served as senior vice president of C2FO, overseeing capital markets, card products and corporate development. He was also head of capital markets at SoFi and began his career at Deutsche Bank in 2003.

Among the reasons that drew Jain to the company were that the founders had product-market fit relatively quickly, and during his due diligence, many of the marketplaces he spoke with were “happy and raving” about the product.

“With the B2B market growing faster than the B2C market — it is going to be nearly $2 trillion by 2023 and B2C will be $1.2 trillion, there is plentiful data to analyze,” Jain added. “The framework and the ground floor are there, and they are excited to build a great culture and talent. We are solving for B2B through a buy now, pay later product, which is bringing emerging technology to the marketplace and access to capital to grow. Overall, we are building a customer-first technology that is going to help democratic access to the digital economy.”

“We have seen a massive evolution of businesses moving online, especially during COVID, so there needs to be some fundamental infrastructure,” said Rebecca Kaden, managing partner at Union Square Ventures, about the investment. “We believed this was missing in the B2B category. Plus, Slope benefits from two-level growth — as customers get bigger, it scales with them and gets new customers along the way. Slope’s product is faster and easier to implement, which is a category advantage, and its growth rate reflects that.”