Products You May Like

Super.mx, an insurtech startup based in Mexico City, has raised $7.2 million in a Series A round led by ALLVP.

Co-founded in 2019 by a trio of former insurance industry executives, Super.mx’s self-proclaimed mission is to design insurance for “the emerging Latin American middle class,” according to CEO Sebastian Villarreal.

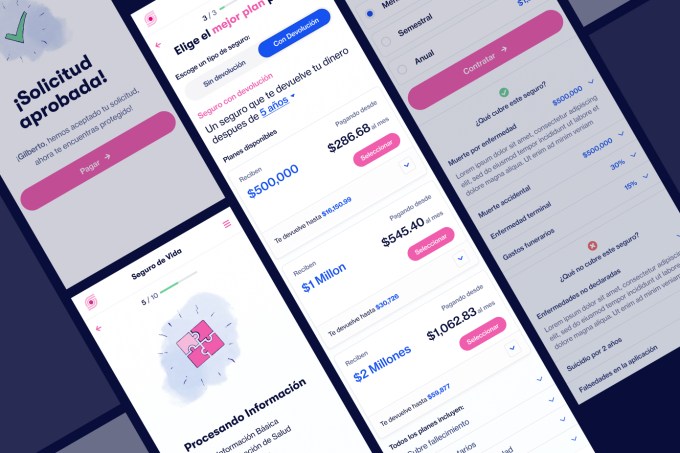

“That means insurance that is easy to buy – it can be bought on a cell phone in minutes – and that pays quickly with no adjusters,” he said. The company has built its offering with proprietary models that are used both on the underwriting side to predict risk and on the claims side to make payments automatically.

Goodwater Capital, Kairos Angels and Bridge Partners also participated in the Series A round in addition to angels such as Joe Schmidt IV, vice president of business development at insurtech Ethos and former investor at Accel and Kyle Nakatsuji, founder and CEO of auto insurance startup Clearcover (and also a former VC). Better Tomorrow Ventures led Super.mx’s $2.4 million seed round, which also saw capital from 500 Startups Mexico, Village Global, Anthemis and Broadhaven Ventures, among others.

Unlike most insurtech startups in Latin America, Villarreal emphasizes that Super.mx is neither an aggregator nor a carrier. Instead, it’s an MGA, or managing general agent.

“This lets us have a ‘best of both worlds’ approach,” Villarreal said. “We handle the entire user experience just like a direct to consumer carrier, but with the breadth of product choice offered by an aggregator.”

That product choice includes property, natural disasters and life insurance. The company soon plans to expand to also offer health insurance.

The founding team brings a variety of insurance experience to the table. Villarreal previously co-founded Chicago-based Kin Insurance (which raised over $150 million in funding from the likes of Flourish Ventures, Commerce Ventures and QED Investors). He was also once head of auto product at Avant, a growth-stage company funded by General Atlantic and Tiger Global, among others.

With over two decades of insurance industry experience, Dario Luna once served as Mexico’s insurance regulator and helped develop Mexico’s disaster risk management strategy. Marco Ahedo has designed parametric insurance products for 19 Caribbean countries. He was also once a solvency expert for life and health insurance lines at MetLife, and has developed financial models for several P&C carriers.

Villarreal lived in the U.S. for a while before deciding to move back to Mexico, which he recognized was home to an “underinsurance problem.”

“That’s actually a very acute problem,” he said. “People in Latin America buy a lot less insurance than they do in the U.S., and people in Mexico, in particular, buy a lot less insurance than they do in other Latin countries.”

Some have blamed the lack of insurance coverage on the country’s culture but Super.mx operates under the belief that this notion is “total BS.”

“It’s not a cultural problem,” Villarreal said. “The problem is that the insurance products that exist in the market just suck. They’re super expensive. They’re really hard to buy, and they pay very little.”

Image Credits: Super.mx

So far, Super.mx has sold “thousands of policies” but is more focused now on increasing the number of products that it’s selling. The company started out by selling earthquake insurance before adding COVID insurance, and more recently, in April, it launched life insurance. Next, it’s going to offer property, renter’s and health insurance.

“It’s really a different strategy than what you would find in the U.S.,” Villarreal said. “In the U.S, when you look at insurtechs, it’s like everyone just does one thing, but here, it’s very different because when someone says ‘I want insurance,’ really what they’re saying is ‘Hey, something happened that makes me nervous that didn’t make me nervous before.’”

That something could be a new child, for example, that prompts a need for life insurance.

“What we’re trying to do is like Lemonade, Roots and Hippo or Kin all rolled into one,” he added. It’s a big, big play.”

Digital adoption in Mexico, and Latin America in general, has increased exponentially in recent years. The bigger hurdle for Super.mx, according to Villarreal, has less to do with technology and more to do with Mexicans getting over what he describes a “deep mistrust” based on bad experiences in the past.

“People are really distrustful and that’s a huge hurdle, but once you show them that you actually are different,” Villarreal told TechCrunch, “that you actually do things in a different way, you get this incredible emotional response.”

Eventually, Super.mx plans to outside of Mexico to other countries in Latin America.

ALLVP’s Federico Antoni said his Mexico City-based firm had been looking for a team building in this space “for years” before investing in Super.mx. The venture firm was impressed with the company’s technical knowledge and industry expertise. It was also drawn to their multi-product approach and “capacity to ship highly complex products to the market quickly” — both of which he believes are “unique” in the region.

Citing statistics from MAPFRE Economics, Antoni pointed out that globally, the insurance market has been growing over the last 10 years. During that time, Latin America expanded faster on average (4.4% vs. 2.4% worldwide), albeit with more volatility. Life insurance has been driving this growth, at 6.1%, over the period.

“Insurtech may be even bigger than fintech. Also, harder,” he told TechCrunch via email. “We knew the team to unlock the market potential would need to be highly competent and highly disruptive.”

Antoni said he is also convinced that Insurtech is the “next frontier” in financial inclusion in Latin America especially as digitization continues to increase.

“Providing risk coverage to individuals and businesses in the region, brings financial stability to families and unlocks economic potential for SMEs,” he said. “Moreover, the insurance incumbents have been unable to address a growing and underserved market.”