Products You May Like

WASHINGTON — Soaring demand for backup connectivity after subsea cables were cut in the Red Sea is helping push Rivada Space Networks closer to fully financing its $2.4 billion constellation plans, according to CEO Declan Ganley.

In the weeks following an incident affecting a quarter of the internet traffic passing between Asia, Europe, and the Middle East, Ganley said March 20 that enterprises have been flocking to the company to learn how its proposed low Earth orbit (LEO) network could provide redundant connectivity between continents.

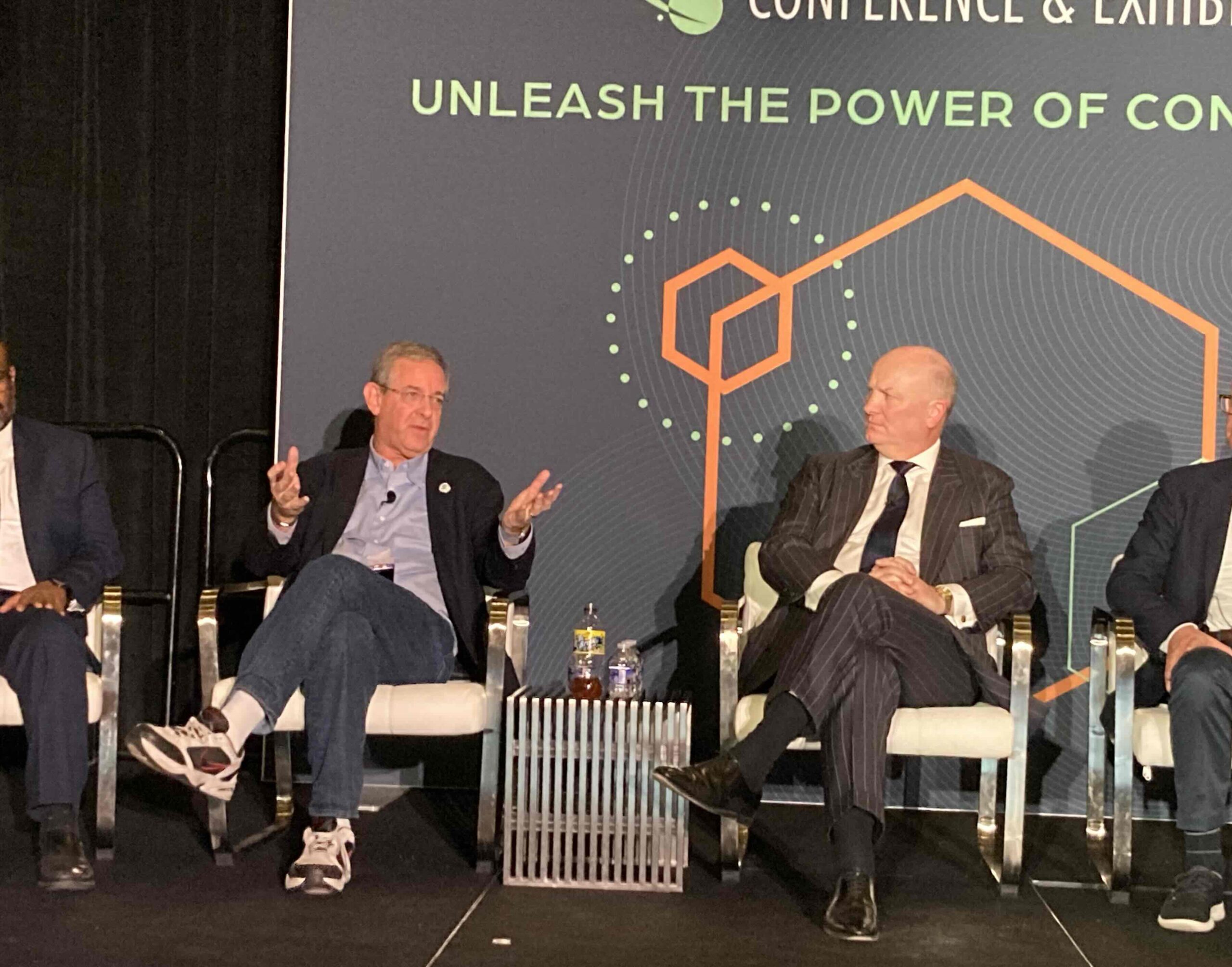

This redundant connectivity need is “something that I hadn’t really fully anticipated in our order pipeline,” he said during the Satellite Conference here, and “may end up being, I would say, in the first 10 contracts that we actually sign” with customers.

He said Rivada Space, a German subsidiary of U.S.-based wireless technology firm Rivada Networks, has Memorandum of Understanding (MoU) agreements with potential customers worth more than $7 billion that it is starting to convert into firm contracts.

The company is also seeking government customers for a network of up to 600 broadband satellites, which would be equipped with optical communications links to avoid the need for terrestrial relay stations.

Customer commitments are critical for attracting equity investors to support the constellation, which paves the way for debt that typically funds the biggest portion of a project backed by an export credit agency.

“We had our first sovereign wealth fund come in towards the end of last year,” Ganley said.

“We expect to have a second one — and possibly even a third one — in the very near term. We have two major strategic investors that are also heavily engaged with us, one that has already made an investment, and we expect to follow through with a significant investment very soon.”

Ganley has shied away from detailing financing plans since acquiring priority Ka-band spectrum rights two years ago from Trion Space, a Liechtenstein shell company, in a deal that prompted a shareholder battle with Chinese interests.

He said that one of the strengths of being a private company is the ability to keep funding plans secret.

Some investors “may have their own reasons for not wanting to disclose [that] they’re shareholders right now,” he said, “especially if you’re a sovereign investor, there may be reasons that you want to keep your cards close to your chest.”

However, this lack of funding clarity has caused headaches for publicly listed Terran Orbital, which is under contract to provide the 300 satellites Rivada must deploy by mid-2026 to comply with its spectrum regulatory license. Terran Orbital’s $2.4 billion contract to build the 500-kilogram satellites makes Rivada its biggest customer.

Terran Orbital told investors Jan. 2 that Rivada had paid all outstanding invoices, but stopped short of breaking down the amount and schedule for future payments from its biggest customer.

Speaking on the same panel as Ganley March 20, Terran Orbital CEO Marc Bell confirmed Rivada remains current on all invoices ahead of plans to deploy two or four prototype spacecraft before the end of the year.