Products You May Like

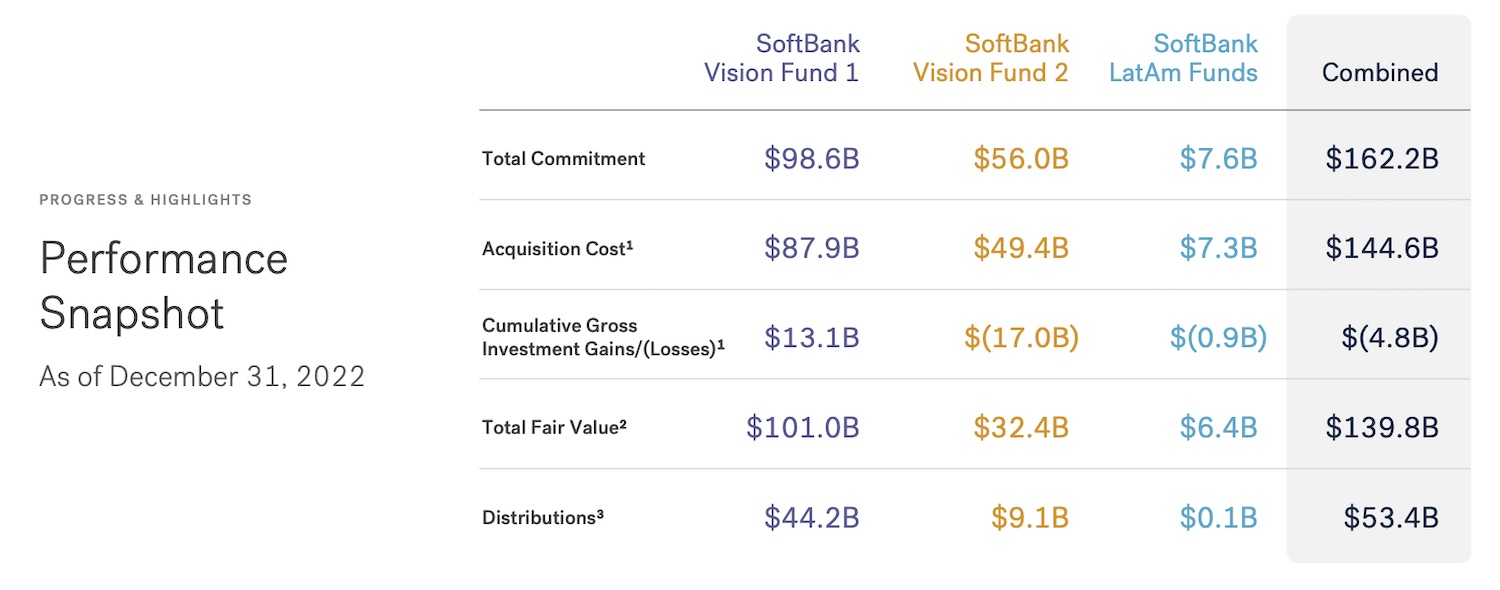

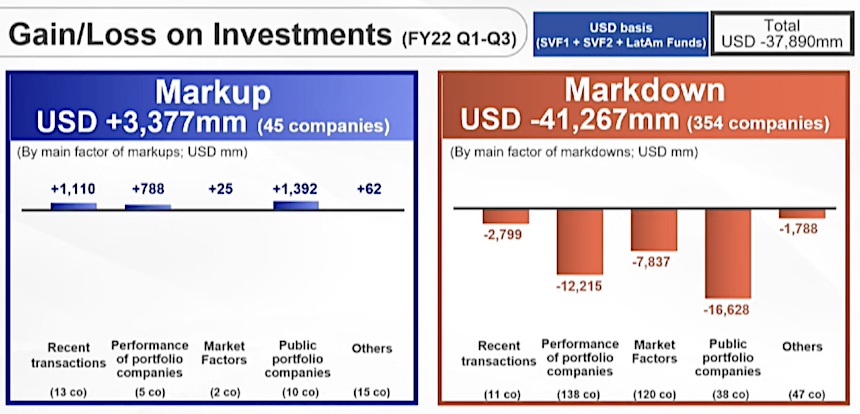

SoftBank Group’s investment vehicles posted a loss of nearly $6 billion in the quarter that ended in December as the Japanese tech investor continues to bleed through the market downturn and significantly pares back new backings.

This is the fourth consecutive quarter in which SoftBank Group has lost money, prompting many to challenge the fundamental thesis of the giant, which has deployed more capital in the tech markets globally than anyone else in the past decade.

SoftBank said it lost $5.8 billion across Vision funds and Latin America fund in the quarter. While a $5.8 billion loss is nothing to write home about, SoftBank will take comfort in the fact that it lost $10 billion in the previous quarter.

The company said the fair value of its current late-stage portfolio is over $37 billion.

In 2021, SoftBank was one of the most prolific investors globally, cutting checks worth over $20 billion in just one quarter as many investors aggressively scrambled to win large deals. As the market reversed early last year, many backers have had to brutally recalibrate their strategies.

SoftBank Vision Fund invested just $300 million each in Q2 and Q3, it said. About 49% of all its investments are now in startups with more than $1 billion in revenue, it said. SoftBank-backed startups raised over $16 billion in 2022, the firm said.

Image credits: SoftBank Group

While the financial health of SoftBank’s private investments is opaque, it’s clear how it has performed in the public markets — and it’s not good.

Overall, SoftBank Vision Fund 1’s holdings in its publicly-listed companies have a fair value of $19.9 billion, compared to the $31.4 billion that the giant invested in them. Through the Vision Fund 2, SoftBank poured $48.3 billion across firms and is currently staring at a loss of $17.6 billion.

While SoftBank’s shares in Coupang stands at a profit of $4.2 billion, the Japanese firm has lost over $9 billion in Didi and $5.1 billion in WeWork.

On the earnings call Tuesday, SoftBank said it’s in the “defence mode” and is preparing for three different scenarios. The firm anticipates that the market may start to show recovery linearly this year, or by second half of this year, or stumble through until early 2024.

SoftBank has sought to bring more discipline across its portfolio firms in the past one year as raising money became exceedingly difficult. Masayoshi Son, founder and chief executive of SoftBank Group, cautioned that the funding winter for startups may continue for longer because some unicorn founders are unwilling to accept lower valuations in fresh funding deliberations. Son skipped the earnings call Tuesday.

SoftBank said it’s taking a “cautious approach” to investing in the blockchain and crypto sector. It has made 26 investments in the category to date, whose current fair value stands at $1 billion. The firm wrote off a $97 million investment it made in the collapsed cryptocurrency exchange FTX.

The firm maintains a “high-conviction” in AI, SoftBank said.