Products You May Like

TAMPA, Fla. — EchoStar Corporation, a U.S. operator with around $1.6 billion in cash, is preparing to disrupt the market for connecting Internet of Things (IoT) devices after ordering satellites it needs for global services next year.

The company said last week it had placed an order with California-based Astro Digital for 28 satellites, which would use S-band frequencies from low Earth orbit (LEO) to connect monitoring and tracking sensors beyond terrestrial networks.

The satellites would use a low-power telecoms protocol called LoRa (long range) that is designed for low-cost, battery-powered devices.

Last year, EchoStar launched a LoRa connectivity network across Europe using S-band from one of its existing satellites in geostationary orbit (GEO), EchoStar 21, which the operator says would interoperate seamlessly with its proposed LEO satellites.

The LEO constellation, operated under the company’s Australia-based EchoStar Global subsidiary, would effectively expand its S-band coverage to compete with rival IoT networks internationally.

According to Northern Sky Research analysts, annual revenues for the small satellite IoT market are set to reach around $1 billion by the end of 2030 as more companies digitize their operations.

Multiple startups have been created in recent years to serve this demand with small LEO satellites that are typically cheaper than their larger GEO cousins, including FOSSA Systems and Sateliot of Spain, Switzerland’s Astrocast, and Australia-based Myriota.

SpaceX is also pursuing this opportunity via seven-year-old U.S. venture Swarm, which it bought in 2021.

EchoStar’s global S-band network would support IoT, machine-to-machine communications, and “other data services,” EchoStar said in a Feb. 1 news release that was light on details.

EchoStar spokesperson Sharyn Nerenberg said the company expects to launch an initial service globally in 2024 after deploying its first batch of satellites.

“Follow-on launches will further densify the system and enhance its performance,” Nerenberg said Feb. 6.

She said EchoStar is in talks with multiple launch providers and expects “to sign a launch contract soon” for the constellation.

“We have clear visibility to launch vehicle capacity and do not see the availability of launchers as a limiting factor,” she added.

Raymond James analyst estimates EchoStar will spend between $100 million and $200 million over several years for the entire constellation.

That’s small change for a company that reported around half a billion dollars in revenue for the three months to the end of September.

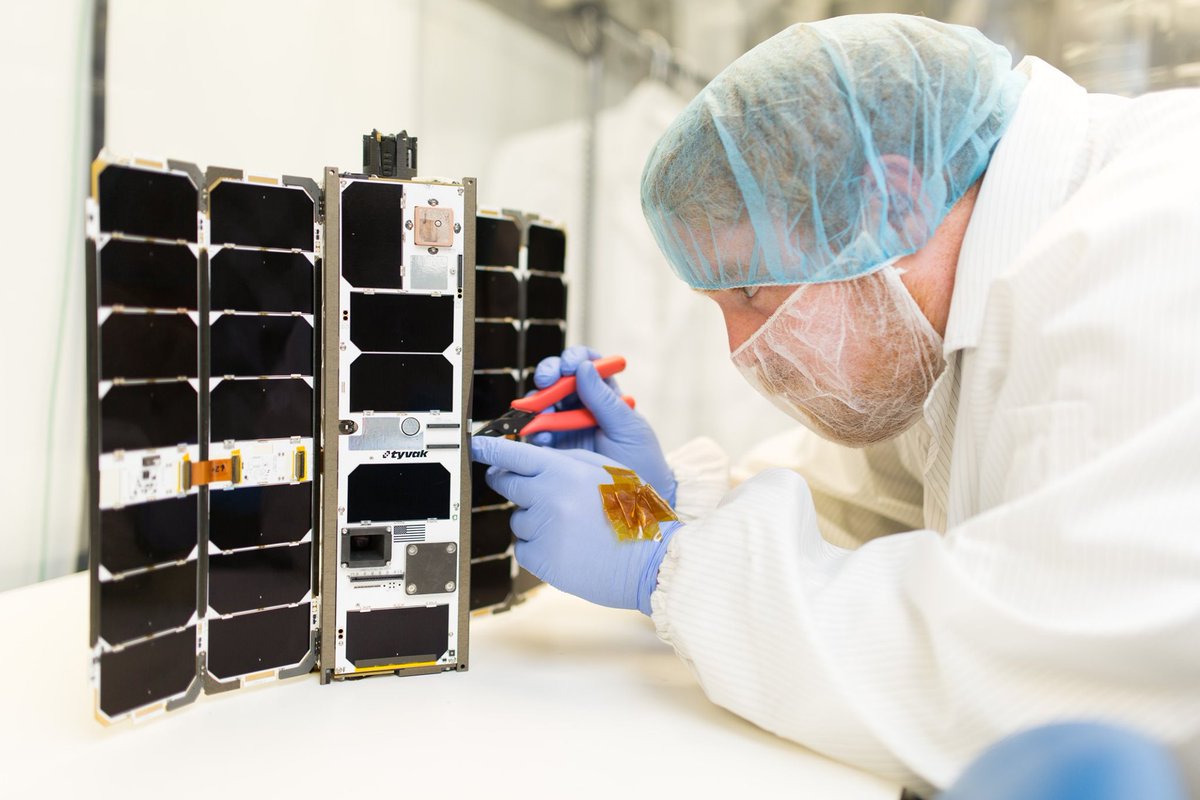

Tyvak Nano-Satellite Systems, now a part of Terran Orbital, built three test nanosatellites for EchoStar’s S-band constellation.

However, only its third satellite successfully reached orbit in 2021. The first two suffered propulsion anomalies after launching on separate rideshare flights in 2020.

In addition to IoT connectivity, the operator uses S-band on EchoStar 21 in GEO to provide voice services across Europe and parts of Africa and the Middle East.

Hamid Akhavan, who became EchoStar’s CEO last year, said in a statement that the proposed LEO network would serve as a stepping stone toward “a global non-terrestrial 5G network.”

He did not define the capabilities of this 5G network, but said the company is working on ways to integrate them with mobile solutions provided by terrestrial telcos.