Products You May Like

Investment in stocks or retirement accounts can seem like a complicated process if you are not sure where to begin.

Mentum is out to change that in Latin America, and is working on customizable investment APIs and widgets so businesses in Latin America can build and offer fully digital investment products, like local mutual funds, ETFs and stocks, to their customers. The products are also compliant with local regulations.

Co-founder and CEO Gustavo Trigos started the San Francisco-based company in 2021 with Simon Avila and Daniel Osvath. The trio, who participated in Y Combinator’s summer 2021 cohort, come from a mixture of backgrounds in payments, technology, APIs and investment services.

All of them came to the U.S. from Latin America to study and work, and in the course of using some of the investment apps offered in the U.S., they struggled to find similar products in Latin America that provided a way to fully invest. And, in Latin America, just 2% of the population in each country have access to investment products, and that’s mainly because they are high-net-worth individuals, Trigos said.

He noted in talking to folks at Chile-based Fintual, which is operating in the retail investing space, why there was not more competition, and what they discussed was a huge gap in the infrastructure and understanding the regulations in each country.

“You have to start from scratch in each country,” Trigos told TechCrunch. “We saw no one was building it, so we did.”

Mentum is not alone in working to provide an easier way for Latin Americans to learn about investing and try it out. In the past year or so, some significant venture capital dollars have been infused into companies, like Vest, Flink and Grupo Bursátil Mexicano, that have also developed investment products as a way to boost financial inclusion within the region.

Trigos considers Mentum a technology company operating in the fintech space versus a fintech company. It started in Colombia and acts as a middle layer, developing technology that companies can build on top of.

One of the early approaches the company took was to reach out to 10 of the top broker-dealers in each country to understand the regulations and build relationships to get the greenlight to do business. While Trigos called that process “burdensome,” once Mentum did that, it was able to more easily repeat the process in Chile and now is eyeing Peru and Argentina for expansion.

Initially, Mentum targeted fintech companies because they already knew how to work with APIs, but then demand started coming in from traditional banks and even supermarkets, insurance companies, credit unions and super apps that deliver food.

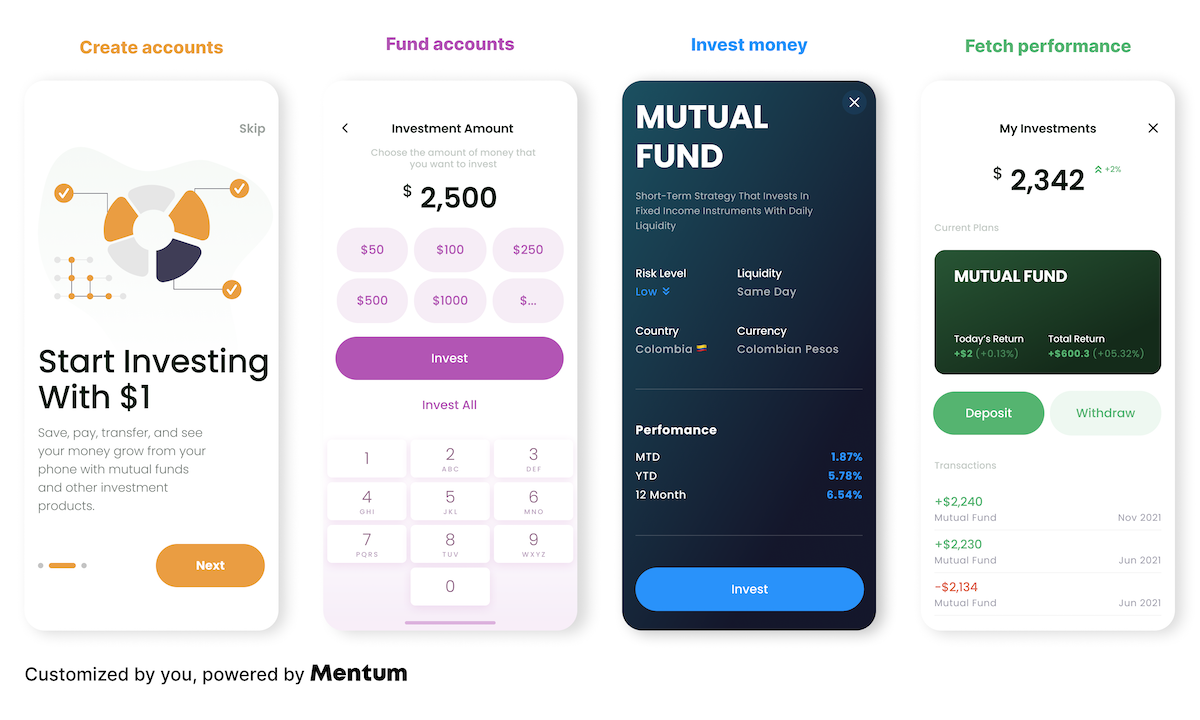

Mentum’s widgets. Image Credits: Mentum

Having so many different kinds of companies eager to offer investment products is a big reason why the company wanted to make its products easier to use, Trigos said.

“We analyzed hundreds of apps to see what the general experience should look like, then we created widgets that do require some code, but we also have a desktop simulator in beta that will require no code to set up the experience,” he added.

Mentum’s products are still in beta, but plans to launch them this year were accelerated by $4.2 million in funding, led by Google’s Gradient Ventures, with participation from Global Founders Capital, Soma Capital Y Combinator and co-founders of Plaid and Jeeves.

Trigos intends to use the new capital to increase its headcount from the seven employees it has now, including setting up its founding team. One of his goals for the year is to grow in Colombia and Chile by integrating five clients in each country. The company will work on product development and features that will enhance the experience, like more payments and adding DeFi and crypto.

Mentum already has two strategic partnerships with broker-dealers and is currently in the integration process with two of its fellow YC-backed fintech companies in Colombia and another 25 companies interested in launching its products.

“The financial services industry is undergoing a massive transformation in Latin America. APIs have created new opportunities for the way we bank,” said Wen-Wen Lam, partner at Gradient Ventures, in a written statement. “With its innovative technology, Mentum has opened up a wide range of possibilities for Latin America fintech apps. We’re excited to back Gus and his team as they usher in the next generation of banking.”