Products You May Like

On Earth Day, April 22, SOSV published the SOSV Climate Tech 100, a list of the best startups that we’ve supported from their earliest stages to address climate change. There are always valuable insights embedded in a list like the 100. A TechCrunch story captured the investment perspective, and an SOSV post went deeper into the companies’ category breakdown and founder profiles.

But what can founders learn from the list about climate tech investors? In other words, who invested in the Climate Tech 100? We dug into the “who’s who” of the list, which had more than 500 investors, and here’s what we found.

An active but fragmented landscape

If you think 500 investors in 100 companies is a lot of investors, you’re right. There are clearly a lot of investors interested in climate tech, and most are generalists just testing the waters. For the Climate Tech 100, about 10% of investors put their money in more than one startup and only seven (less than 2%) wrote a check to four or more. These included Blue Horizon, CPT Capital, EF, Fifty Years, Hemisphere Ventures and Horizons Ventures.

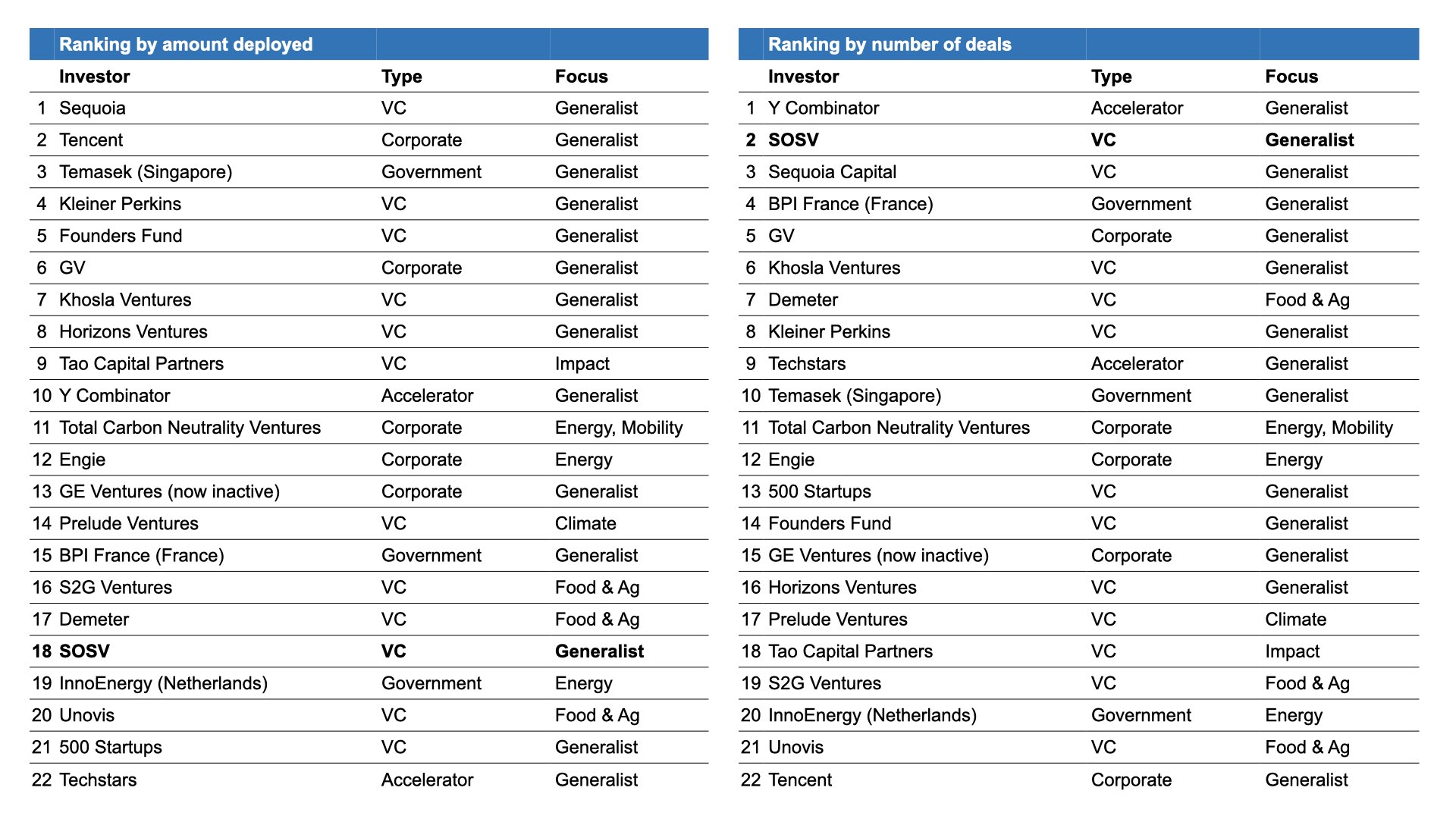

That pattern tracks well with data from PwC, which found that 2,700 unique investors had backed 1,200 startups in its State of Climate Tech 2020 report covering the 2013-2019 period. The report found that only 10 firms out of 2,700 made four or more climate tech deals per year, on average, over the 2013-2019 period. The most active firms are listed in the table below.

Image Credits: PwC, 2020; additional research by SOSV

Capital deployed in climate tech grew at five times the venture capital overall growth rate over the 2013-2019 period.

There is reason to believe that the fragmentation will diminish with the launch of more funds focused on climate tech. Four funds worth more than a billion dollars each have launched since 2020 that fit the description (see chart below).

It’s also encouraging to see that capital deployed in climate tech grew at five times the venture capital overall growth rate over the 2013-2019 period.

Even so, climate tech still only represented 6% of total venture capital deployed in 2019, so there is plenty of room to grow.