Products You May Like

HawkEye 360 CEO John Serafini: Government contracts help startups raise private funds needed to pay for the space and ground infrastructure.

WASHINGTON — About 270 of the 620 remote sensing satellites in orbit are privately owned with about 200 of these belong to U.S. companies, according to the Aerospace Corp. Only about 50 are owned by the U.S. military or intelligence agencies.

These numbers show the rapid commercialization of a previously tightly held government national security technology, Josef Koller, systems director at the Aerospace Corp. said Feb. 11 at the SmallSat Symposium.

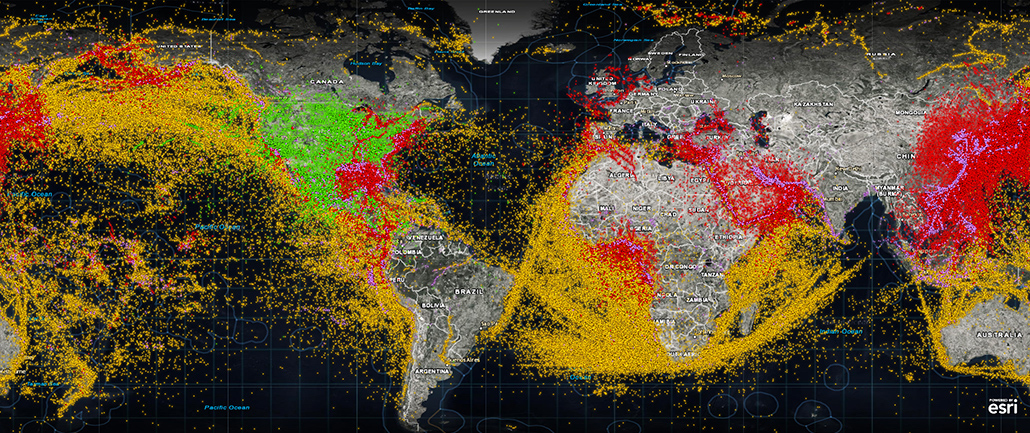

Koller noted that companies are collecting increasingly sophisticated geospatial intelligence from satellites and are using artificial intelligence to analyze imagery.

Organizations like the National Reconnaissance Office and the National Geospatial Intelligence Agency plan to increase their business with commercial remote sensing ventures like Maxar, Planet and BlackSky. But remote sensing startups moving into the defense market would like to see DoD and other agencies develop long-term plans to procure commercial capabilities, said John Serafini, CEO of HawkEye 360. He noted that DoD has a number of programs to fund studies and experiments but that is not enough to help the industry generate revenue and attract more private investment.

Serafini’s company provides radio-frequency signal location data gathered by satellites, and also does analysis of the RF data.

There are national security organizations like the Defense Innovation Unit, In-Q-Tel and AFWERX focused on “bringing interesting intellectual property and commercial capabilities into the Department of Defense and the intelligence community,” Serafini said. “They do a good job of that.”

The problem is that these organizations keep companies in “research, development, testing and evaluation cycles” for several years. Companies that have proved their technologies need opportunities to “scale into meaningful programs of record that can create true value to the end customer,” he said.

Being able to get steady government contracts helps to get new rounds of financing that is needed to pay for the space and ground infrastructure. “That’s really challenging,” Serafini said.

If the commercial industry is going to be a national asset that supports government agencies, said Serafini, Congress should consider providing funds to DoD and intelligence agencies “as a bridge” to get past the research phase and fund procurement of remote sensing services.

Startups in this sector that want to break into the government market have to make huge investments in infrastructure, in military-specific requirements such as security clearances and in lobbying to gain traction on Capitol Hill, Serafini said. “That’s not something a startup in Silicon Valley wakes up and knows how to build.”

A Feb. 9 report by the Lexington Institute, a think tank funded by defense companies, calls on the U.S. government to step up support for the commercial geospatial intelligence industry as foreign competitors increasingly are able to match and surpass the offerings of U.S. companies.

“As with many other industries where the U.S. was once dominant, foreign providers of geospatial intelligence have increased market share in part by exploiting subsidies from their governments,” says the Lexington report. “China in particular is investing heavily in methods of collecting and analyzing geoint.”